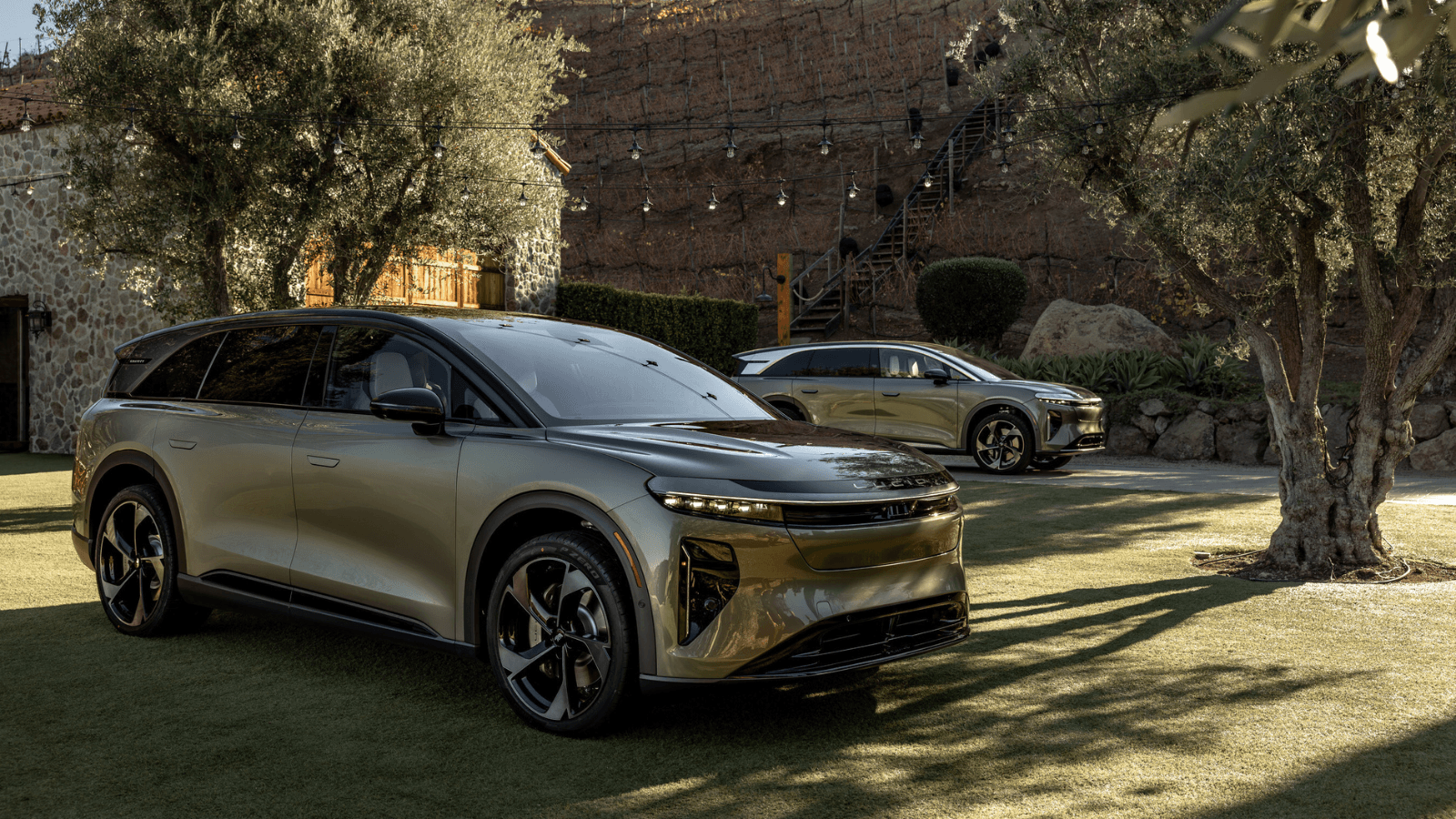

Uber Becomes Major Lucid Shareholder With 20,000 Gravity SUV Order

Interim CEO Marc Winterhoff confirmed the automaker’s current cash reserves, about $4.86 billion in cash and credit facilities, will not carry it to break-even.

Lucid Motors is leaning on a new partnership with Uber to strengthen its path toward profitability, even as the company acknowledges it will need to raise more equity by 2026. Interim CEO Marc Winterhoff confirmed the automaker’s current cash reserves, about $4.86 billion in cash and credit facilities, will not carry it to break-even.

The warning comes amid ongoing losses, high production costs, and the recent removal of key EV incentives in the United States.

Uber deal offers validation and new revenue paths

In July, Uber became Lucid’s second-largest shareholder after the Saudi Public Investment Fund, investing $300 million and agreeing to purchase 20,000 Gravity SUVs for a planned self-driving fleet set to launch in a U.S. city next year. Winterhoff described the deal as a “validation” of Lucid’s advanced technology, calling the order a starting point with potential for global expansion, according to the Financial Times.

The partnership could eventually reach Europe and the Middle East, where Lucid is developing new production capacity. Beyond supplying vehicles, Lucid is also exploring the option of becoming a fleet manager itself—owning the self-driving SUVs and renting them out to Uber drivers. This approach could create a steadier revenue stream and reduce reliance on volatile retail sales.

Policy changes and equity raise on the horizon

Despite technological advantages such as market-leading driving range, Lucid continues to lose hundreds of thousands of dollars per car sold. A major setback came when the Trump administration ended the $7,500 federal EV tax credit and eliminated emissions trading programs, both of which had provided crucial revenue for Lucid, Tesla, and Rivian. Winterhoff admitted those changes represented “a big number of pure profit” lost, but stressed they were not central to Lucid’s long-term strategy.

Looking forward, Lucid is betting on more affordable models to broaden its market reach. A mid-size SUV priced around $50,000 is planned for 2026, compared with the Gravity’s $94,900 sticker price. Early signs of shifting demand are already visible, with sales boosted by Tesla owners seeking alternatives to aging model lineups. However, Lucid’s shares remain down about 95% from their 2021 peak, underlining investor concerns over whether the Uber deal and upcoming products can close the gap to profitability.

EV.com tracks the evolving EV collector space and performance electric vehicles hitting the market. Explore our listings to find the best EVs in your area available today.

Comments

Categories

Subscribe for EV News and Reviews

AI Employee for Car Dealerships

Results in 30 days - Or We'll Give You Your Money Back