New EV Sales Set To Overtake Gas Cars In The UK By 2028

A New Cox Automotive Report Projects EVs Will Account For 36% Of New Car Sales By 2028, Outpacing Petrol Vehicles As The UK Automotive Industry

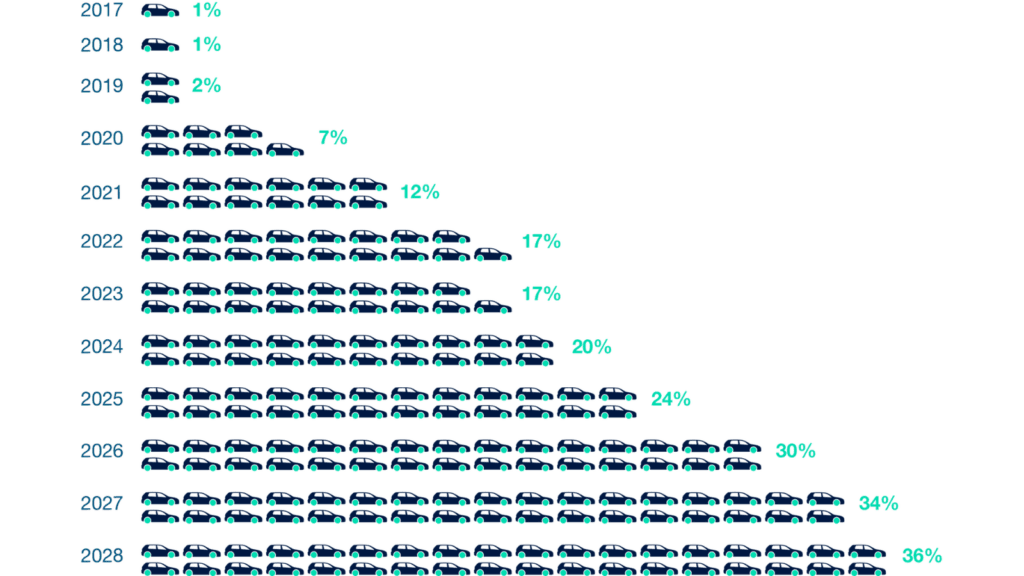

In an influential shift for the United Kingdom (UK) automotive industry, electric vehicles (EVs) are projected to overtake petrol car sales by 2028, according to a new four-year forecast from Cox Automotive. The report predicts EVs will capture 36% of new car registrations by 2028, while petrol vehicles will decline to 30% market share, marking a historic transition in British motoring.

A Dramatic Shift in the UK Auto Market

The transformation of the UK’s automotive landscape has been remarkable over the past four years. Since 2020, nearly 980,000 EVs have entered the market, representing an extraordinary growth of 560%. This surge stands in stark contrast to traditional fuel types, with diesel experiencing a dramatic 76% decline to just over 6% market share in 2024, while petrol sales have decreased by 26.6%, losing 1.4 million units during the same period.

However, despite this promising trajectory, the industry faces significant hurdles in meeting the government’s Zero-Emission Vehicle (ZEV) mandate targets. The current forecast falls considerably short of the mandated 52% EV registration requirement for 2028, highlighting the gap between policy ambitions and market realities.

Cost Barriers and Consumer Concerns

Cost remains a primary barrier to wider EV adoption, according to a joint consumer attitudes survey by Cox Automotive and Regit. The research revealed that 69% of drivers are unwilling to pay the current premium for EVs, which typically cost about 12% more than their petrol or diesel counterparts. Additionally, an overwhelming 86% of consumers are calling for increased government incentives to encourage the transition to EVs.

The broader automotive market is also undergoing significant changes. Philip Nothard, Insight Director at Cox Automotive, predicts a “volatile” period ahead as the sector navigates economic challenges and evolving consumer preferences. “The next four years will see continued transformation as new manufacturers, particularly from China, enter the market while established brands adapt their strategies to meet changing regulations and customer demands,” he explains.

Modest Growth Forecast for 2025

The UK market is expected to show modest growth in 2025, with new car registrations forecast to exceed two million units, representing a 1.5% increase over 2024. However, this figure remains 13.3% below the 2001-2019 average, indicating the industry’s ongoing recovery challenges. The slow return of private buyers, whose registrations have declined by 19.2% between 2020-2024, has contributed to a significant deficit of 1.7 million fewer vehicles on UK roads during this period.

Adding to this dynamic landscape is the arrival of new automotive brands. The UK market now hosts over 60 manufacturers, following recent entries from companies like BYD, Jaecoo, Omoda, and Skywell. These newcomers are actively challenging established players, pushing traditional manufacturers to innovate and adapt to maintain their market position.

Moreover, industry experts emphasize that achieving the two million registration milestone in 2025 will be crucial for the UK’s automotive recovery. Success will largely depend on new market entrants building consumer trust and the continued support of the fleet and leasing sectors, which have been instrumental in driving EV adoption through tax incentives and other benefits.

As the UK EV industry continues to evolve, the interplay between consumer acceptance, manufacturer innovation, and policy support will be crucial in determining the pace of this historic transition in British motoring.

Want to learn more about EV? Thinking of buying an EV? Head over to EV.com and discover more.

Comments

Categories

Subscribe for EV News and Reviews

AI Employee for Car Dealerships

Results in 30 days - Or We'll Give You Your Money Back