Adevinta’s Survey Finds Brand Loyalty Shift As EVs Reshape European Market

Adevinta’s Survey Reveals 28% Of European Buyers Are Open To New EV Brands

As the electric vehicle (EV) market sees an increase in automakers joining the competition, the recognition and brand loyalty from buyers in this space has seen a fluctuation. A recent survey by Adevinta reveals that the transition to EVs is reshaping brand loyalty in the European automotive market.

According to Adevinta’s survey, it researched 5,000 European buyers. It also indicated that brand reputation remains vital, with 45% citing it as the top factor in vehicle-buying decisions. Notably, 28% of respondents are more inclined to purchase an EV from a new or unfamiliar brand than a traditional internal combustion engine (ICE) vehicle.

When it comes to the key factors influencing buyers to consider new EV brands, these factors include superior battery range by 39%, affordability 35%, and quick availability by 26%. However, reliability remains a concern with nearly 29% of buyers distrusting the reliability of models from new automakers.

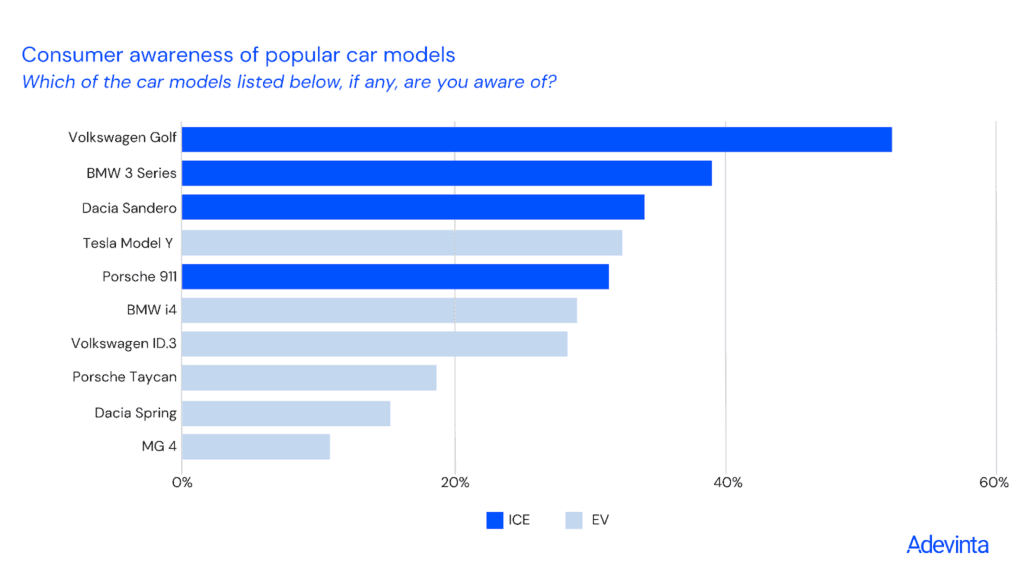

Furthermore, Adevinta’s survey underlines a notable gap in buyer awareness between EV models and their ICE counterparts. As an example, while 52% of respondents recognized the Volkswagen Golf including as the highest level of buyer awareness, only 28% were familiar with its electric counterpart, the ID.3 model.

Interestingly, Tesla leads in EV reputation with 48% of buyers ranking it at the top, followed by Volkswagen and BMW at 26% each. Although renowned EV-focused automakers including Polestar and BYD, despite their global presence, were recognized as reputable by just 11% and 9% of buyers, respectively.

Ajay Bhatia, Head of Adevinta’s global mobility portfolio, expressed the findings of the survey stating, “In the fast evolving EV market, established manufacturers can no longer rely on brand loyalty alone to secure market share. So, in order to stay front of mind for a new generation of EV buyers, there is a job to do to build trust by alleviating concerns around key barriers to adoption, such as cost and battery range.”

Rise of New EVs in Europe

Regarding the European market, it is rapidly becoming one of the top markets for EVs to thrive in. With the European EV market booming with 2023 sales hitting 3.2 million units and generating $146 billion in revenue, automakers are certainly taking advantage of this wave to supply for buyer demand.

In particular, Chinese EVs have appeared on the scene to showcase their advanced EV technology and staggering affordability that leaves a strong impression to potential buyers. Yet, the implementation of new tariffs at 37.6% on Chinese EVs from the European Union (EU) has placed obstacles ahead for them. Nevertheless, the Europe still remains a stronghold with EVs as the projected revenue in the European EV market is estimated to hit $182.9 billion in 2024.

As the European EV market is expected to grow by 18% year-on-year with one in four EVs sold in Europe predicted to be made in China for 2024, the competition is set to intensify. Nonetheless, these numbers are expected to change with the new tariff rates on Chinese EVs.

With suggestions from Adevinta’s survey showing that established European automakers need to double down on marketing efforts and improve their EV offerings to maintain their position, newcomers must aim on building trust and reputation to compete effectively in this evolving EV market.

As a result, this changing automotive landscape with EVs involved presents both challenges and opportunities for established and emerging automakers alike in the race for EV dominance in Europe.

Want to learn more about EVs? Thinking of buying an EV? Head over to EV.com and discover more.

Comments

Categories

Subscribe for EV News and Reviews

AI Employee for Car Dealerships

Results in 30 days - Or We'll Give You Your Money Back